Jonathan Crosbie, Senior Documentation Officer, Birmingham Chamber of Commerce, writes:

The governing body of The Giftware Association has been working closely with HM Revenue & Customs to get as much clarity as possible in issuing, processing and regularising Carnets so that that you can continue to ship goods temporarily as efficiently as possible.

The purpose of this note is to give you information on ATA Carnet issue if there is a ‘no deal’ situation and the UK leaves the EU at 11pm on 31st October 2019 on World Trade Organisation terms. This note therefore assumes that:

• 1st November 2019 is Day 1 (D1) of the UK trading on WTO rules

• That it has been confirmed that ATA Carnet can be used for temporary imports and exports between the UK and the EU 27 after D1, as it used for signatory countries in the rest of the world

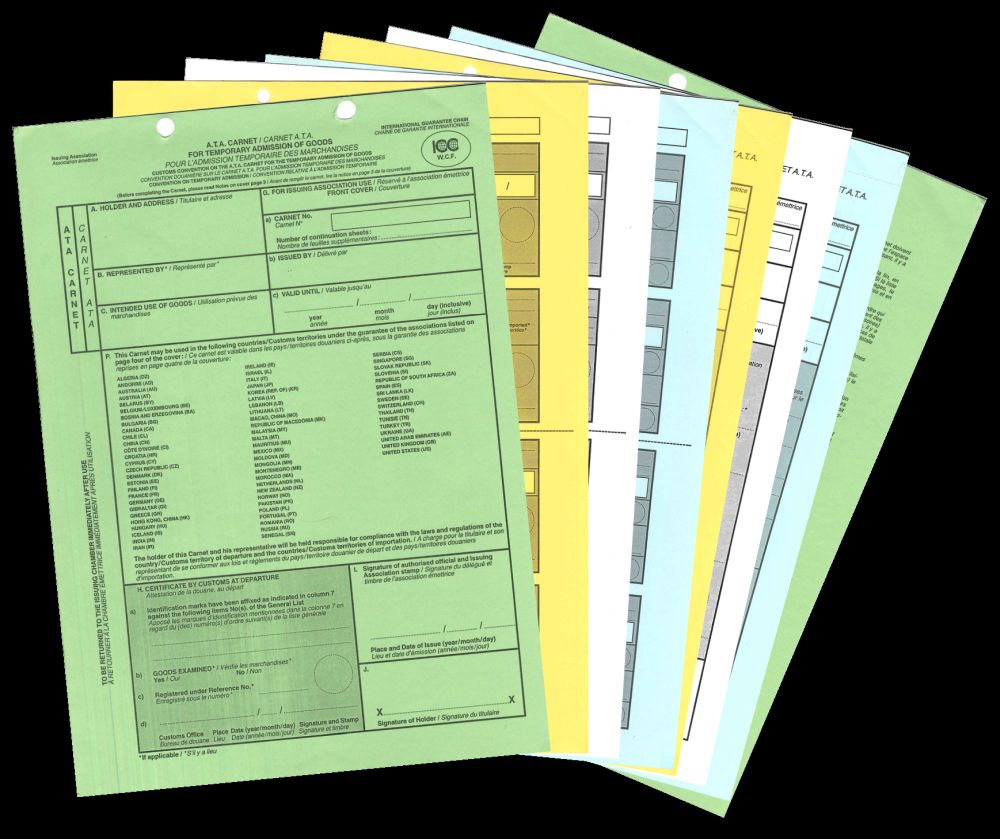

The GA has produced a new ATA Carnet document with amendments to the front and back covers (where the UK was classified as an EU member) to reflect the fact that the UK has officially left the EU. The new format will be supplied by your issuing Chamber and must be used from November 1 2019/ D1.

The EU is one bloc and therefore one destination for ATA Carnet goods. Once the goods have been imported in to the EU they will be free to move around all EU members. The single security rate we will be requiring customers to provide for the bloc is 40 per cent. There are a number of scenarios which relate to the issue of ATA Carnets affected by the UK’s changing status.

Scenario 1: “I/My goods are going to the EU after D1”

Once Brexit takes place, it is very likely that you will be able to use ATA Carnets for temporary movement of goods in to Europe. We will be able to issue these from 1st November. Once the items are imported in to Europe, they can travel to any other EU member state before finally being re-exported.

Scenario 2: “I/My goods are in EU now or travelling to EU before D1 but not coming back until after”

If goods are already in EU now or they are going out before D1, you will not have an ATA carnet for these. If the goods return to the UK after D1 then there is a chance they will be stopped at the border by Custom. As it stands you should send out a duplicate list or an invoice for customs purposes only alongside your goods dated prior to D1.

The document should be prepared on your company letterhead and list items exported including serial numbers, identifying marks, quantities and values. Destination and Intended use of the goods must also be stated at the end of the document.

You may also be asked to complete form C&E1246 as well as provide proof of UK status of these items to claim a returned goods relief on return to the UK.

Scenario 3: “I/My goods are in a Non-EU country now (ie Switzerland or Norway) on a carnet and are returning to the UK via road”

In the unlikely event that your goods are returning to the UK via road after D1 and you have an ATA Carnet already issued for this then you may need to obtain some Blue Transit vouchers from us for your carnet. Transit vouchers cover movement of goods when they are not actually being imported in to a territory for Commercial Samples /Exhibition/ Professional Equipment purposes and are only transiting through the area to get to your final destination.

If you have an ATA Carnet and need some transit forms for this then please contact your issuing Chamber of Commerce and request these.

For further advice you can contact Jonathan Crosbie on 0121 274 3217 or j.crosbie@birmingham-chamber.com