According to retail analyst, Springboard, from Sunday 21st November through to Saturday 4th January, it is predicted that footfall across all UK retail destinations will average -17% lower than 2019, continuing the current trajectory seen in September 2021 with footfall down -17.4%.

The anticipated supply issues facing retailers this year is likely to lead to consumers bringing their Christmas purchasing forward to November in order to guarantee the availability of their desired gifts. Diane Wehrle, Marketing & Insights Director for Springboard, predicts that Black Friday will be more popular this year, with week 47 [week beginning 21st November] seeing a boost in footfall of +7.9% and +6.5% in week 48, as shoppers take advantage of widespread discounting to visit stores to ensure they secure the gifts they want. This contrasts with the average uplift in footfall in Black Friday week of +5.1% between 2014 and 2019 and +1.7% in Black Friday week in both 2018 and 2019.

Croydon, UK

This year, the drop in UK footfall from 2019 will be driven by high streets and shopping centres where, over this six week period, footfall will be -17.7% and -17.5% lower than 2019 respectively. In contrast in retail parks, where footfall has been far more resilient throughout the pandemic, it will continue to strengthen and will average +5.5% higher than 2019 over the six week period. Retail parks are likely to be particularly strong over the last two weeks of the Christmas trading period, averaging +11.8% higher than 2019, as pre-Christmas food shopping is undertaken in the week running up to Christmas.

Wehrle comments: “Retail parks will continue to increase their customer base this Christmas. This further boost over the trading period, to what is an already strong footfall base in retail parks is likely to be a result of shoppers heading to larger stores where they feel safe, but which also offer a wide range of products, are easy to access with free parking and many of which provide convenient click and collect facilities.”

Large city centres will strengthen over the festive period

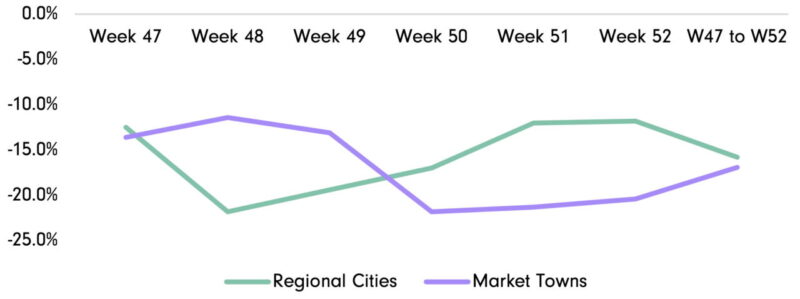

Footfall in large city centres will strengthen over the six week Christmas period, overtaking smaller high streets. This will contrast with UK footfall trends seen throughout the pandemic, as consumers look to seek out the Christmas shopping experience they missed last year. Footfall increases from week to week will be greater in regional cities than in market towns in each of the six weeks, and it will mean that the gap in footfall from 2019 in regional cities will average -15.8% versus -16.9% in market towns. The increased attractiveness of larger city centres to consumers at Christmas can be seen in the forecast uplift from 2020 of +140.3% in regional cities versus +47.5% in market towns over the six week period.

UK footfall is likely to continue to rise into the week of Christmas [week 51], with an increase of +6.5% from the week before. With Christmas Day falling on a weekend this year, this provides a longer final trading week offering consumers an opportunity to shop in store in the immediate days leading up to Christmas when it cannot always be guaranteed that online purchases will be delivered in time.

The week post Christmas, kicks off with Boxing Day on Sunday. Since 2016, footfall has declined on Boxing Day every year, dropping by -8.6% in 2019 from Boxing Day in 2018. This is unlikely to change this year as footfall is not only generally lower on Sunday due to reduced hours, but also a number of leading retailers have already announced that they will not be opening, which will lead consumers to defer trips, and use this day to spend with family. In the week post Christmas, footfall in high streets and shopping centres will drop by around -20%, and this level of decline post Christmas has been a trend for the past decade. However, a need to replenish food and groceries post Boxing Day combined with discounting will continue to drive increased footfall into retail parks in the week following Christmas.

Wehrle comments: “This year, the ongoing impact of the Covid-19 pandemic, along with the supply issue associated with the shortage of HGV drivers, which has already affected stock in food stores and led to the recent fuel crisis, will unfortunately cause further issues for bricks and mortar retailers over the Christmas trading period. In addition, the end of the furlough scheme, coinciding with recent increases in energy prices are likely to further dampen footfall as household spend on Christmas gifts is constrained and family experiences are favoured.

“Although footfall will be +80.9% stronger in comparison to 2020, this result is distorted as last year retailers were forced to close their doors for four weeks from the beginning of November, which overlapped, with two of the six week Christmas trading period. Whilst footfall will rise over the Christmas trading period, it will remain lower than pre-pandemic levels, part of which is the long term shift of some spend online which has impacted footfall by around -1.5% per annum for the past decade.”