Retail analyst Coveo surveyed 4,000 consumers across the UK and USA to get a pulse on shopper sentiments as we head into the golden quarter for retailers. They found that consumers can find themselves overwhelmed by the demands of shopping and gift-giving whilst juggling tight budgets and schedules.

It was also found that retailers have reason to be optimistic. When asked about any changes to their gifting plans for the 2024 season, 76% of consumers said they plan to maintain or increase their gift giving and spending compared to last year. This number indicates robust consumer confidence and an opportunity to boost sales during the gifting season for retailers ready to tap into holiday enthusiasm.

The data reveals an intriguing dichotomy: Eighty-five percent of shoppers expressed at least one concern about shopping for the holidays including, budget (29%), buying the right gift (14%), and timely delivery (11%). Yet the exact same percentage (85%), shared that they often make impulse purchases online. This dilemma underscores the conflicting emotions shoppers face — the tension between planning and budgeting for holiday gifts versus the irresistible lure of spontaneous purchases.

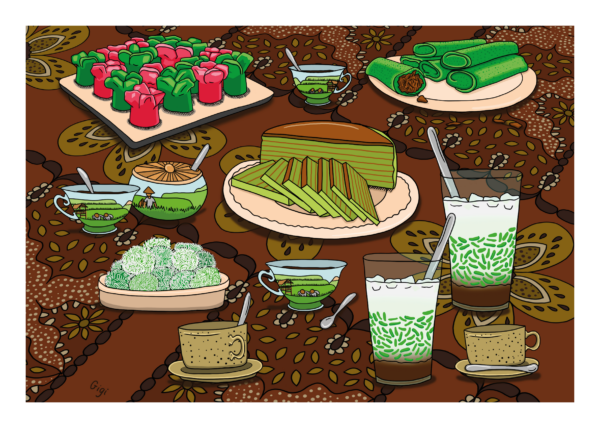

Fashion items were most likely to lure shoppers into spontaneous purchases (45%) closely followed by food and beverages, confectionary and wellness products (44%). Beauty products were tempting to 31% of shoppers whilst home, garden, decor, toys and games are able to attract 25% of shoppers to make impulse purchases.

Featured: British makers, Moose & Co, Bill Baber, Juniper Calluna, Miss Knit Nat, Spuggy Designs, Umm Pixies, Stockwell Ceramics.

Retailers can encourage impulse buying online by ensuring that shoppers can easily search and find what they’re looking for on your site. Offer dynamic filtering options and provide real-time availability by attribute directly on listing or results pages. Capitalise on potential impulse buying by displaying relevant deals and product recommendations that complement their cart.

In line with their gifting plans, 59% of shoppers intend to tighten their belts in other areas, cutting back on dining out, socialising, travel, and entertainment. Gen Z and Millennials are leading the charge, with 74% and 68% respectively planning significant cutbacks in all areas to afford their holiday spending.

The numbers are clear; shoppers are more than willing to open their wallets, especially when tempted by special deals. An impressive 90% of shoppers are open to adding items to their existing orders during this festive season, presenting a golden opportunity for retailers to supercharge their holiday sales.

Tactics like free shipping, relevant special offers, and personalized recommendations tap into the shopper’s mindset of finding the perfect gift.

Retailers can boost their average order value with product recommendations tailored to each context and intent. Deploy recommendation strategies such as trending or popular products on your homepage, personalised product recommendations on product detail pages that evolve in real-time according to site interactions, and the perfect add-to-cart recommendations to get them to their free shipping threshold.

The appeal of holiday deals is significant, with over two-thirds (68%) of shoppers planning to visit one or more retailers during Black Friday and Cyber Monday. Electronic stores, fashion and apparel, and big box/department stores are the most popular destinations. While only 27% of U.S. shoppers say they don’t shop on either of these days, this number rises to 36% for the U.K., where Thanksgiving isn’t celebrated.

Featured: British makers Papersheep, Mortimer Cartridge Woodturning, Hannah Longmuir Arts, Hazel Williams Laser Cut Designs.

While physical stores remain key in the shopper’s buying journey, digital plays a pivotal role, no matter where they purchase. Shoppers often research online and purchase in-store or vice versa. Meeting customers at every touchpoint is crucial. Effective search and product discovery not only drive online conversions, but also significantly impact in-store revenue.

80% of consumers said they discover special offers via digital sources, including email, social media, online search, and online marketplaces.

Social media is especially crucial for Gen Z, with 65% using platforms like Instagram and TikTok, compared to 35% of other age groups. This underscores the need for a consistent omnichannel experience.In the U.K., 51% of respondents are more aware of deals through online/in-store ads than in the U.S. (44%) and are less influenced by print mailings/coupons (13% vs. 27% in the U.S.).

Your website is a critical conversion point. Despite the growing trend of discovering products via social channels, most consumers still prefer to search online and purchase from a retailer’s website. Retailers should ensure they are not wasting their digital advertising and promotion spend by losing shoppers once they land on their site with a sub-par product discovery experience.

While 45% of U.S. shoppers enjoy the thrill of finding the perfect gift, only 39% of U.K. shoppers share the same sentiment. What’s clear from the survey findings is that the holiday shopping experience is not universally cherished. In fact, 20% of shoppers are indifferent, viewing it as just another task to complete, and 19% admit to dreading the process due to the time and expense required.

This difference in attitudes highlight the importance for retailers to create a more enjoyable and efficient online shopping experience. By helping consumers find what they’re looking for, you reduce the risk of them leaving your site to look elsewhere. Sixty-one percent of consumers said that specific search categories such as “gifts for dad” or “gifts under $50” would be helpful when gift shopping online.

Featured: Stockwell Ceramics. Molten Wonky, Beadstorm Designs, A Little Trinket, Hazel Williams Laser Cut Designs, Dreya Glass Studio.

Richard Lim of Retail Economics echoed the “bad news/good news” sentiment, saying that the “economic climate is resulting in a ‘cautiously optimistic’ attitude across retail”. The last quarter of 2024 will be more fruitful for the trade than it has been for the past few years, with retailers gradually building more margin and consumer confidence creeping up, despite fears about the October budget.

Neil Bellamy of research firm GfK, said: “We’ve got 50 years of consumer confidence data and people in the UK are never particularly positive, but consumer confidence is gradually improving. We’re seeing a pattern – things are starting to level off. ‘Those with the most money are showing increasing signs of confidence after a challenging time”.

British handmade continues to top the wishlist for many shoppers in the UK. Retailers looking to capitalise on this growing support for locally made products can source from the trade-focused British Craft Directory. All products featured here can be found on the Directory.