The UK furniture & floorcoverings market is set to outperform the total non-food market through 2029 as economic conditions improve and consumers feel more confident about making big-ticket purchases again. This momentum is already underway in 2025, with the market forecast to grow 2.2% and it will maintain this growth out to 2029, according to GlobalData,.

GlobalData’s report, “UK Sector Series: Furniture & Floorcoverings, 2024-2029,” reveals that the furniture & floorcoverings market is forecast to grow by 10.0% between 2025 and 2029, nearly a percentage point higher than the total non-food market (+9.1%).

Matt Walton, Senior Data Analyst of Retail at GlobalData, comments: “The market is poised to gain from a strengthening economic backdrop that is restoring confidence in big-ticket spending, alongside a recovering housing market that reinforces a core demand driver for furniture. Continued real wage growth through to 2029, combined with consumers allocating a smaller share of income to savings, will further underpin market expansion.”

More affluent shoppers have supported the market in 2025, as they are more able to make big-ticket purchases and have seen a greater uplift in their discretionary incomes. This has led to a shift towards more premium retailers and ranges as quality is pivotal to these shoppers, a trend reflected across all customer groups.

Consumer data in the UK Sector Series: Furniture & Floorcoverings report revealed that quality is the main factor in determining if a furniture and homewares product is good value for money or not, as shoppers see furniture purchases as a long-term investment. This is a trend that GlobalData expects to continue throughout the forecast period as more shoppers become able to trade up.

Walton concludes: “This greater emphasis on quality means the specialists are forecast to be among furniture’s big winners in 2025, with DFS, Dreams and Furniture Village gaining share. The higher levels of service provided by these retailers and their greater focus on design, highlighted by DFS’s capsule collections, have helped attract affluent shoppers, boosting performance. Specialists outside of the top 10, such as Sofology and Magnet, are also expected to gain share. As such, interest-free credit will become increasingly more important to encourage a wider customer base to trade up.”

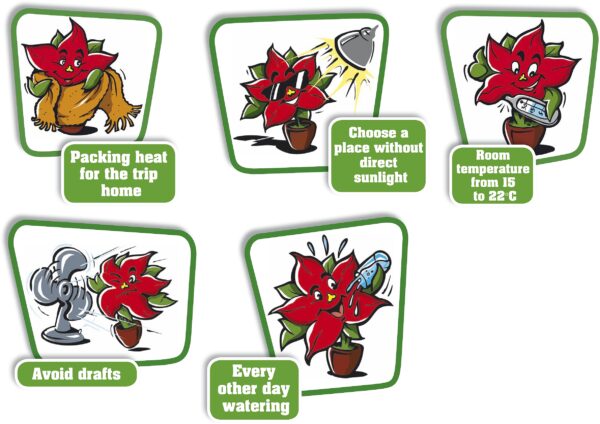

Image by Stars for Europe.