Alan Monahan writes: A bouquet for the Federation of Small Businesses, which has once again turned the spotlight on retailers.

Alan Monahan writes: A bouquet for the Federation of Small Businesses, which has once again turned the spotlight on retailers.

This was prompted by a rise in employment to 75.4% – the highest level since records began – and a drop in the number of self-employed people by 30,000 to 4.76 million.

It is independents who are increasingly feeling the strain as rising employment costs coincide with another round of business rates hikes for thousands of small shops.

That’s why the FSB is calling for a better deal for retailers and campaigning for the Employment Allowance to be raised to £4,000, which would go some way to helping ensure record numbers of people are still in work over the months ahead.

Chairman Mike Cherry is right when he says that small firms have played a huge role in achieving record-high employment. So, with the national living wage and auto-enrolment contributions rising this month, we need to see more support for them in managing the costs that come with making high employment a reality.

He also warns that any upcoming Bank of England interest rate rise must be gentle enough for small firms to absorb if recent gains in economic confidence and investment are not to be put at risk.

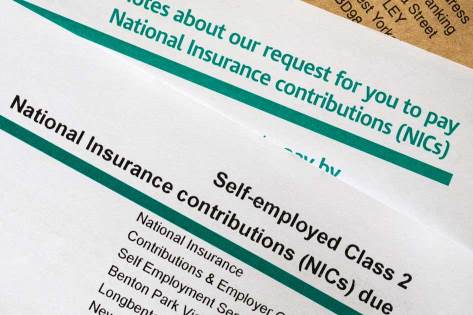

Then there is the drop off in the number of self-employed workers, which Cherry describes as ‘concerning’ as he stresses the need to avoid an environment that is increasingly hostile to the genuinely self-employed, forcing them to take permanent contracts.

‘Only this month they were promised an end to Class II National Contributions which hasn’t manifested,’ he says. ‘Equally, they’re up against a Universal Credit system which, as it stands, poses a threat to UK entrepreneurship. We know if takes at least two to three years to get a firm off the ground. Enforcing the Minimum Income Floor for the self-employed after 12 months is anti-business, pure and simple. The Universal Credit regime should reflect this reality.’

‘Only this month they were promised an end to Class II National Contributions which hasn’t manifested,’ he says. ‘Equally, they’re up against a Universal Credit system which, as it stands, poses a threat to UK entrepreneurship. We know if takes at least two to three years to get a firm off the ground. Enforcing the Minimum Income Floor for the self-employed after 12 months is anti-business, pure and simple. The Universal Credit regime should reflect this reality.’

The flexibility and ingenuity of the self-employed community has been vital to UK growth in recent years. And that’s why Cherry says that it should be properly recognised. Few would deny that.

Good retail news is hard to find these days and it was depressing to discover that, year-on-year, footfall in March decreased by 6% -– a substantial decline compared to the positive rate of 1.3% seen for March 2017. What’s more, it was the steepest year-on-year fall for more than seven years.

There was no growth for any of the UK regions, according to the BRC-Springboard footfall and vacancies monitor, with the most notable declines in Greater London, the South East and the East Midlands. High streets saw a decline of 8.6%, while retail parks and shopping centres saw falls of 1.8% and 4.8% respectively.

There was no growth for any of the UK regions, according to the BRC-Springboard footfall and vacancies monitor, with the most notable declines in Greater London, the South East and the East Midlands. High streets saw a decline of 8.6%, while retail parks and shopping centres saw falls of 1.8% and 4.8% respectively.

Unfortunately, these figures can’t just be attributed to the prolonged period of bad weather. BRC chief executive Helen Dickinson believes that we are seeing a longer term trend of reduced footfall which highlights that all shoppers face more choice in terms of how, where and when they shop.

You’ve heard it before: the retail environment is changing and retailers are investing in innovation and technology adaptations in response to this. They’ve no choice!

But as Dickinson says, policy-makers must also play their part with a vision for a modern business taxation system which reflects this new environment.

The negative impact that the Beast from the East had on UK economic activity last month doesn’t entirely explain March’s lacklustre consumer spending, according to Mark Antipof, chief commercial officer at Visa. He thinks we are in the midst of a dip in consumer confidence and this – coupled with other economic factors – is causing shoppers to continue to restrain themselves.

High street sales suffered once again, but what surprised me was that the e-commerce spend fell for the first time in 10 months – and by its fastest rate since 2012.

High street sales suffered once again, but what surprised me was that the e-commerce spend fell for the first time in 10 months – and by its fastest rate since 2012.

If there is a dip in consumer confidence, it isn’t apparently shared by companies. Data from accountants and business advisors BDO suggests that the UK economy is in a strong position, with hiring intentions at record levels and business output at its highest in seven months.

But like Mike Cherry, who wants a ‘gentle’ Bank of England rate rise, BDO partner Peter Hemington is calling for the Monetary Policy Committee to hold fast and keep interest rates to a minimum. He believes this will encourage confidence and growth for UK businesses, which are retaining a positive outlook despite the recovery remaining ‘patchy and febrile with Brexit looming’.

They would have been relieved to hear that BoE governor Mark Carney believes that an interest rate rise in May is not a foregone conclusion.

Meanwhile, retail sales in the US bounced back in March after three consecutive months of decline. If it’s true that Britain catches a cold when America sneezes, we must hope that Uncle Sam’s return to health bodes well for the UK. But I won’t be holding my breath.